In some instances, a company’s management may initiate new policies to prevent the recurrence of actions that led to losses through litigation. The above conflict produced unsettled and conflicting accounting practices concerning non-operating items. Recognition in the second case may involve allocation among the periods either based on observed revenue generation or on a predetermined time-oriented basis. Consequently, accountants attempt to discover if revenue and expenses share a connection.

Adjustments and Expense Management

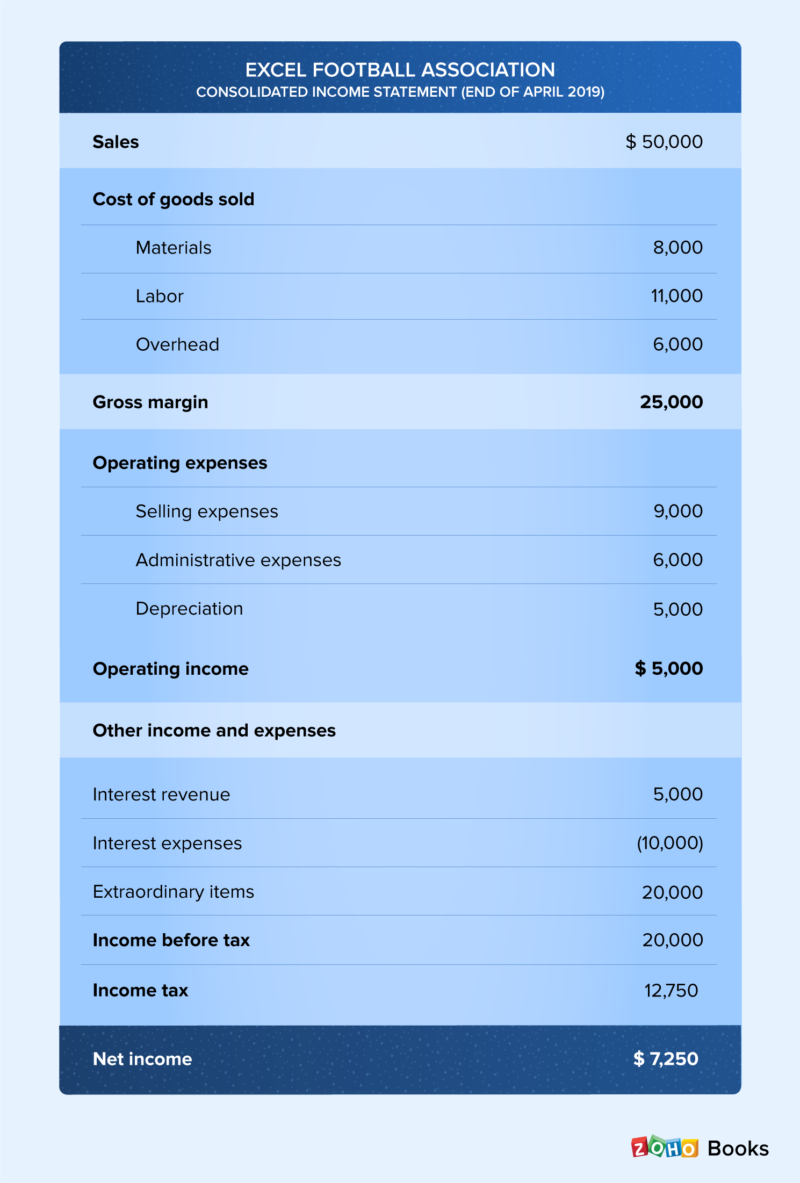

Direct costs can include parts, labor, materials, and other expenses directly related to production. This makes it easier for users of the income statement to better comprehend the operations of the business. This means that revenues and expenses are classified whether they are part of the primary operations of the business or not.

Income Statement: Tracking Profit and Loss in a Predefined Period

The statement of shareholders’ equity shows changes in ownership and retained earnings over time. It helps us understand how much has been reinvested into the business and how that will impact long-term growth and sustainability. Financial statements are essential for determining performance, making strategic decisions and accountability by anyone, from managers to investors.

Types of Financial Statements: A Complete Guide

Accounting software often automatically calculates interest charges for the reporting period. An income statement should be used in conjunction with the other two financial statements. Directors and executives are also provided a clear picture of the performance of the company as a whole during a specific accounting period. It is also practical to use this format when you do not need to separate operating expenses from the cost of sales. Operating expenses totaling $37,000 were then deducted from the gross profit to arrive at the second level of profitability – operating profit which amounted to $6,000. EBIT is helpful when analyzing the performance of the operations of a company without the costs of the tax expenses and capital structure impacting profit.

Revenues

It is common for companies to split out interest expense and interest income as a separate line item in the income statement. Most businesses have some expenses related to selling goods and/or services. Marketing, advertising, and promotion expenses are often grouped together as they are similar expenses, all related to selling. Operating revenue is realized through a business’ primary activity, such as selling its products. Non-operating revenue comes from ancillary sources such as interest income from capital held in a bank or income from rental of business property.

- Income statements are designed to be read top to bottom, so let’s go through each line, starting from the top.

- It provides insights into a company’s overall profitability and helps investors evaluate a company’s financial performance.

- The statement of shareholders’ equity shows changes in ownership and retained earnings over time.

Aside from EBT, there’s also EBITDA, EBIT and a slew of other abbreviations you might want to familiarize yourself with to be even more confident when reading an income statement. The income statement amounts are best calculated for a specific period of time by using the accrual basis of accounting. Under the accrual basis of accounting, the Service Revenues account reports the fees earned by a company during the time period indicated in the heading of the income statement.

The degree of difficulty will probably differ, depending on the company, but it may be hardest for manufacturing companies that do business around the world. This builds knowledge which will help business owners and investors with the ability to take confidence to make an informed decision towards growth and stability. It also tells us how profits should be distributed, irs courseware how we should pay dividends or how we should reinvest in the business. It’s essential for investors to understand these standards so they can compare to a common benchmark. How accurate these statements are, depends on the actual management style used, and these estimates may differ. Financial statements are a record of the past, not of the present or the future.

Doing so enables the user and reader to know where changes in inputs can be made and which cells contain formulae and, as such, should not be changed or tampered with. Regardless of the formatting method chosen, however, remember to maintain consistent usage in order to avoid confusion. Finally, we arrive at the net income (or net loss), which is then divided by the weighted average shares outstanding to determine the Earnings Per Share (EPS).

Financial statement is an information regarding income, expenses, assets, liabilities and equity to understand the financial status of the company. These steps only note the actions required to manually shift income statement information from the trial balance to a manually-prepared income statement. All accounting software has a standard income statement report that automatically presents the information noted in the preceding steps. Subtract the selling, general and administrative expenses total from the gross margin to arrive at pre-tax income. Aggregate all cost of goods sold line items on the trial balance and insert the result into the cost of goods sold line item in the income statement. The cost of goods sold typically includes the costs of direct labor, direct materials, and factory overhead.